The smart Trick of Estate Planning Attorney That Nobody is Discussing

Wiki Article

Things about Estate Planning Attorney

Table of ContentsSome Of Estate Planning AttorneyGet This Report on Estate Planning AttorneyEstate Planning Attorney - An OverviewEverything about Estate Planning Attorney

Your lawyer will certainly additionally aid you make your files official, scheduling witnesses and notary public trademarks as needed, so you do not have to bother with trying to do that final step on your own - Estate Planning Attorney. Last, however not the very least, there is beneficial tranquility of mind in developing a connection with an estate planning attorney that can be there for you in the futurePut simply, estate planning lawyers supply value in many means, far beyond just supplying you with printed wills, trust funds, or other estate preparing files. If you have questions concerning the process and intend to find out more, call our office today.

An estate planning lawyer helps you formalize end-of-life decisions and lawful files. They can set up wills, develop depends on, produce health and wellness treatment directives, develop power of attorney, produce succession strategies, and a lot more, according to your dreams. Dealing with an estate preparation lawyer to complete and manage this legal documentation can help you in the adhering to eight areas: Estate intending attorneys are specialists in your state's count on, probate, and tax obligation laws.

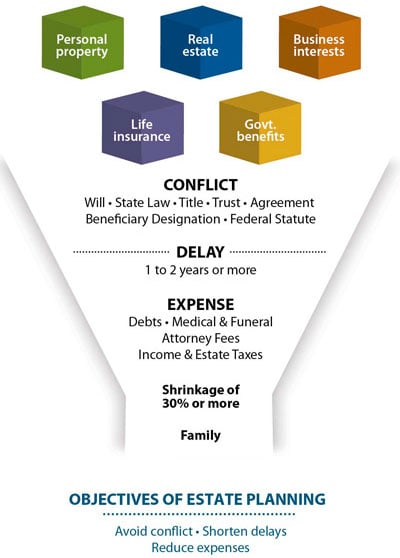

If you do not have a will, the state can decide exactly how to split your assets among your successors, which might not be according to your desires. An estate preparation lawyer can help organize all your legal papers and disperse your properties as you wish, potentially staying clear of probate.

3 Easy Facts About Estate Planning Attorney Described

As soon as a client passes away, an estate strategy would determine the dispersal of possessions per the deceased's directions. Estate Planning Attorney. Without an estate plan, these decisions might be entrusted to the near relative or the state. Obligations of estate coordinators consist of: Creating a last will and testimony Setting up count on accounts Naming an administrator and power of lawyers Determining all beneficiaries Naming a guardian for small kids Paying all financial obligations and reducing all taxes and lawful charges Crafting directions for passing your values Developing preferences for funeral arrangements Wrapping up guidelines for care if you become unwell and are not able to choose Getting life insurance coverage, impairment income insurance policy, and long-lasting treatment insurance coverage A good estate strategy ought to be upgraded consistently as customers' financial scenarios, personal inspirations, and federal and state regulations all developAs with any type of profession, there are features and skills that can aid you accomplish these objectives as you collaborate with your customers in an estate planner duty. An estate planning job can be ideal for you if you have the complying with traits: Being an estate coordinator means believing in the lengthy term.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

You should help your client expect his/her end of life and what will certainly occur postmortem, while at the exact same time not home Continued on morbid thoughts or feelings. Some customers may end up being bitter or distraught when contemplating fatality and it can drop to you to help them through it.In the occasion of fatality, you may be expected to have content numerous discussions and ventures with enduring family members about the estate strategy. In order to stand out as an estate planner, you might require to stroll a fine line of being a shoulder to lean on and the individual trusted to interact estate planning issues in a prompt and expert manner.

Expect that it has actually been modified even more considering that after that. Depending on your client's monetary earnings brace, which might evolve toward end-of-life, you as an estate coordinator will certainly have to maintain your customer's assets in full legal compliance with any type of neighborhood, government, or international tax laws.

Not known Facts About Estate Planning Attorney

Gaining this accreditation from companies like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Being a participant of these specialist teams can verify your abilities, making you much more eye-catching in the eyes of a potential client. Along with the emotional benefit of assisting clients with end-of-life preparation, estate coordinators appreciate click here to read the advantages of a steady earnings.

Estate preparation is an intelligent thing to do no matter of your current wellness and economic standing. Not so lots of individuals know where to start the procedure. The initial important thing is to employ an estate planning lawyer to help you with it. The complying with are five benefits of collaborating with an estate preparation lawyer.

An experienced lawyer understands what information to include in the will, including your beneficiaries and special factors to consider. It also gives the swiftest and most efficient technique to move your properties to your beneficiaries.

Report this wiki page